Dividend

The distribution of the dividend allows you to share in our successes by receiving a proportion of our profits.Our policy is to distribute 50% of our net income (Group share), excluding any capital gains on disposals, retroactivity and funding for new projects.

The 2020 dividend

The 2020 dividend was approved by the Combined General Meeting of Shareholders held on 25 May 2021, which also approved an option for shareholders to receive 50% of the dividend in the form of new shares, thereby introducing a choice between receiving 100% of the dividend in cash, or 50% in new shares and 50% in cash.

In practice

The amount of dividend per share: €0.80

Strike price of new shares offered in payment of the dividend for shareholders opting to receive 50% of their dividend payment in new shares: 32.59 €

Ex-date (the date on which the amount of the dividend is deducted from the share price): 10 June 2021

Record date: 11 June 2021

Period during which shareholders may opt to receive 50% of their dividend in the form of new shares

- Opening date: 14 June 2021

- Closing date: 5 July 2021

Payment date for cash dividends: 9 July 2021

Settlement date for shares offered in payment of the dividend for shareholders opting to receive 50% of their dividend payment in new shares: 9 July 2021

Taxation of private individuals who have their tax residence in France

Note: the information on our website does not constitute tax advice. It is your responsibility to verify your tax situation as it pertains to payment of the dividend.

The 2020 dividend paid in 2021 both in cash and in shares is subject to the 30% flat tax regime, including 17.2% in social security tax and 12.8% in income tax. This flat tax is withheld at the source, which means that it is deducted directly from the dividend by the payer prior to payment.

Two points should be made regarding this new tax regime applicable to dividends since the beginning of 2018.

- You may opt for application of the progressive income tax scale instead of the flat tax if this method of taxation is more advantageous based on your marginal tax rate. This option is global, which means that it applies to all your dividends and other investment income received in 2021. Here again, the dividend received will have previously been subject to a 30% withholding tax, including 17.2% in social security tax and 12.8% in income tax. However, the 12.8% income tax withheld will be treated as an advance payment on the tax due in 2022 on your 2021 income. The progressive income tax scale will then be applied to the gross dividend amount less a tax abatement of 40%, and opting for this regime also allows you to benefit from the deductibility of the CSG (generalised social contribution) paid at a rate of 6.8%. If your tax in 2022 exceeds the 12.8% advance payment withheld on the dividend paid, you will need to pay the additional tax. Otherwise, the excess amount of the advance payment will be refunded to you by the tax authorities.

- Whether or not you opt for application of the progressive income tax scale, if your 2021 taxable income does not exceed certain thresholds (€50,000 for a single person or €75,000 for a couple taxed jointly), you may be exempt from the 12.8% income tax, provided you applied for this exemption at your financial institution before 30 November 2021. This exemption allows you to defer the payment of your tax (you will then pay this tax in 2022 at the time of payment of your 2021 income tax).

Dividends received on a stock savings plan are not subject to income tax. Therefore, they are only subject to the 17.2% withholding for social security tax.

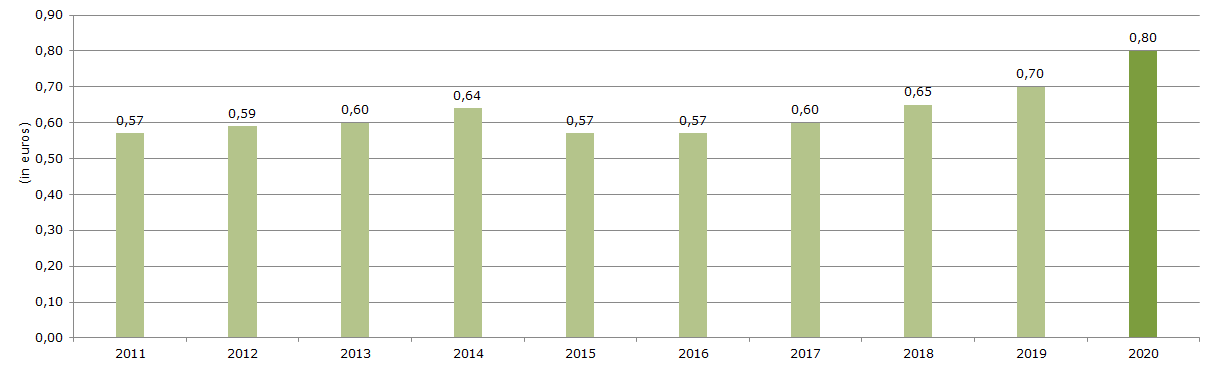

The trend in dividend payments since 2011